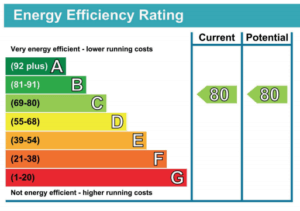

EPC – Energy Performance Certificates

An Energy Performance Certificate or EPC is required when a property is built, sold or rented. The EPC must be obtained or at least booked in before the property in marketed for sale or rent. In Scotland you must display this EPC somewhere in the property for any tenants etc., often this is next to the boiler or meter cupboard if internal.

The EPC contains two vital pieces of information – information about a property’s energy use and typical energy costs and recommendations about how to improve this rating to reduce energy use and save money.

An EPC will rate a property from A (most efficient) to G (least efficient) and will be valid for 10 years.

In order to search for an EPC visit the Government’s website here for England and Wales and for Scotland visit this site.

Which buildings are exempt?

A few buildings are exempt from an EPC these include listed buildings from 2013. However if you get an EPC for a listed building voluntarily you must renew it every 10 years.

- listed buildings

- places or worship

- temporary buildings that will be used for less than 2 years

- some buildings that are due to be demolished

- stand alone buildings with a useable floor space of under 50 square metres

- industrial sites, workshops and non-residential agricultural buildings that do not use a lot of energy

- holiday accommodation that is rented out for less than 4 months a year or is let under a licence to occupy

- residential buildings intended to be used for less than 4 months a year

Can I opt of the EPC Register

Yes you can. Visit the EPC Register website to undertake this. Although at the end of 2020 the website was moved from Landmark to a .gov

.uk website for the Government and this page has not be recreated. So in the meantime email [email protected], or call their helpdesk on 020 3829 0748 (Monday to Friday, 9am – 5pm)

How can I improve my EPC rating?

Your EPC will also come with a recommendation report containing advice and improvements that will make your property more energy efficient. Your assessor’s suggestions may include:

- Installing cavity wall and loft insulation

- Draught-proofing windows and doors

- Insulating pipes and tanks

- Installing a condensing boiler

- Reducing water usage

- Considering energy efficient glazing

- Considering renewable energy technology such as a wood fuelled heater, solar panels or wind turbines

- Installing low-energy usage light bulbs

When do I need to renew my EPC?

If your Energy Performance Certificate expires, you are not automatically required to get a new one. You will only need to get a new EPC if you intend to let to a new tenant, or wish to sell the property.

Government guidance states: “Once an EPC reaches the ten-year point and expires, there is no automatic requirement for a new one to be commissioned. A further EPC will only be required the next time a trigger point is reached, i.e. when the property is next sold, let to a new tenant“.

Minimum EPC rating to rent my property?

The Domestic Minimum Energy Efficiency Standard (MEES) Regulations set a minimum energy efficiency level for domestic private rented properties. As from 1st April 2020 it became a legal requirement to have at least an E rating or better within England and Wales. This includes both new and existing ratings. There are proposals to increase this further in England and Wales. But at this time they remain proposals.

In Scotland you will require an E at least by March 2022. Then from 1st April 2022 a new tenancy will require at least a band D with this stretching to all properties by 31st March 2025.

Exemption to new EPC rules for lettings

In England and Wales, there are over one million domestic buildings with an EPC rating of F or G – that’s around 6% of properties.

There are some exceptions as to which properties must comply with the new regulations. These will only apply in a small number of cases. If one of these apply, you can register for an exemption on the PRS Exemptions Register.

You would need to show that one of the following applies:

- All ‘relevant energy efficiency improvements’ have been made – Where the landlord has made all the relevant energy efficient improvements that can be made and the property remains sub-standard.

- Measures cannot be wholly financed – Where the landlord is unable to access relevant no cost funding to fully cover the cost of installing the recommended improvement(s) either within a seven year payback, or under the Green Deal’s Golden Rule

- Third Party Consent Exemption – Where the landlord is obliged to obtain a third party’s consent to undertake relevant improvements and consent was denied, or was provided with unreasonable conditions

- Occupying Tenant Consent Exemption – Where the landlord requires consent from an occupying tenant, and the tenant withholds that consent. A tenant’s consent may not be required where the tenancy agreement allows the landlord to enter to carry out improvements (not just repairs)

- Property Devaluation Exemption – Where measures required to improve the property are shown by a suitably qualified independent surveyor, as expected to cause a capital devaluation of the property of more than 5%. Only those measures that are expected to cause such devaluation would be exempt from installation

- Wall Insulation Exemption – no requirement to install wall insulation under the Regulations where the landlord has obtained written expert advice advising that it is not an appropriate improvement due to its potential negative impact on the fabric or structure of the property (or the building of which it is part)

- Recent Landlord Exemption – in certain circumstances where a person becomes a landlord suddenly, a temporary exemption form the prohibition on letting a sub-standard property will last for six months after the date they became the landlord

- The cost cap: you will never be required to spend more than £3,500 (including VAT) on energy efficiency improvements.

Funding improvements to your property

The cost cap: you will never be required to spend more than £3,500 (including VAT) on energy efficiency improvements.

If you cannot improve your property to EPC E for £3,500 or less, you should make all the improvements which can be made up to that amount, then register an ‘all improvements made’ exemption.

There are 3 ways to fund the improvements to your property:

Option 1: Third party funding

If you are able to secure third-party funding to cover the full cost of improving your property to EPC E, you can use this and you don’t need to invest your own funding:

- the cost cap does not apply

- you should make use of all the funding you secure to get your property to band E, or if possible higher. Funding can include:

- Energy Company Obligation (ECO)

- local authority grants

- Green Deal finance

Option 2: Combination of third-party funding and self-funding

If you can secure third-party funding but it is:

- less than £3,500, and

- not enough to improve your property to EPC E

you may need to top up with your own funds to the value of the cost cap.

Please note

- you can count any energy efficiency investment made to your property since 1 October 2017 within the cost cap

- if your property can be improved to E for less than the cost cap, that is all you need to spend

Option 3: Self funding

If you are unable to secure any funding, you need to use your own funds to improve your property. You will never need to spend more than the cost cap.

You do not need to spend up to £3,500 if your property can be improved to EPC E for less. If you can improve your property to E for less than the cap, you will have met your obligation.

If it would cost more than £3,500 to improve your property to E, you should install all recommended measures that can be installed within that amount, then register an exemption.

If you have made any energy efficiency improvements to your property since 1 October 2017, you can include the cost of those improvements within the £3,500 cost cap.

Registering an exemption

There are various exemptions that apply to the prohibition on letting a property with an energy efficiency rating below E.

If your property meets the criteria for any of the exemptions, you will be able to let it once you have registered the exemption on the PRS Exemptions Register.

Information required for all exemptions

- address of the property

- type of exemption you are registering

- copy of a valid EPC for the property

‘All relevant improvements made’ exemption

Register this exemption if the property is still below EPC E after improvements have been made up to the cost cap (£3,500 incl VAT), or there are none that can be made.

This exemption lasts 5 years. After that it will expire and you must try again to improve the property’s EPC rating to E. If it is still not possible, you may register a further exemption.

To register this exemption, you need to provide this additional information:

- if you didn’t rely on your EPC report to select measures appropriate for your property, and instead opted for a report prepared by a surveyor for example, you must provide a copy of that report

- details, including date of installation, of all recommended improvements you made at the property (unless none were recommended)

‘High cost’ exemption

Register this exemption if no improvement can be made because the cost of installing even the cheapest recommended measure would exceed £3,500 (including VAT).

This exemption lasts 5 years. After that it will expire and you must try again to improve the property’s EPC rating to E. If it is still not possible, you may register a further exemption.

To register this exemption, you need to provide this additional information:

- 3 quotes from qualified installers for purchasing and installing the cheapest recommended measure, demonstrating that the cost would exceed £3,500 (including VAT)

- written confirmation that you are satisfied that the measure exceeds £3,500 (including VAT)

For additional guidance click here for all the other possible exemptions

Page updated: 11th February 2021